How to control your accounts with Microsoft Dynamics?

Microsoft Dynamics is a suite of enterprise resource planning (ERP) and customer relationship management (CRM) software applications that businesses can use to manage their finances, operations, and customer relationships. One key feature of Microsoft Dynamics is its ability to help businesses control their accounts and financial information.

What system manages accounts and finances from Microsoft Dynamics?

What system manages accounts and finances from Microsoft Dynamics?

Whether you run a multinational or a construction company, an accurate financial snapshot is essential for success and expansion. Current financial management software provides owners and managers with quicker access to more accurate insights regarding payables, receivables, fixed assets, and other essential financial data points.

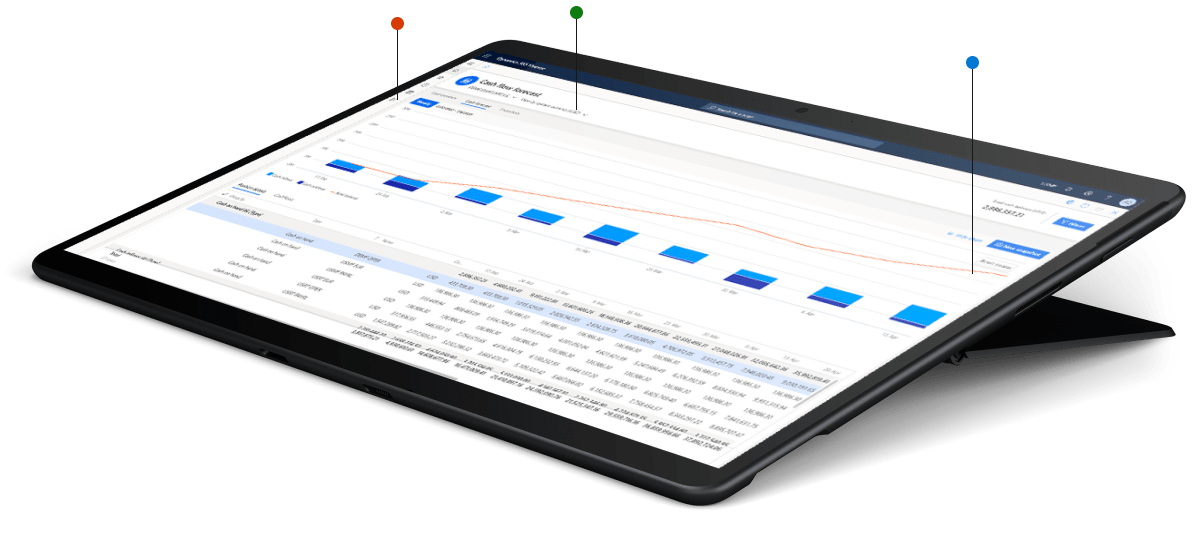

As part of a comprehensive enterprise resource planning (ERP) system, a modern financial management system enables you to see and manage essential financial and operational data via dashboards that integrate all financial and business data on a single platform.

What is Microsoft Finance Program?

1-Take charge of the company’s finances.

A high-quality financial management system will incorporate bookkeeping functions to track income and spending, assets and liabilities, and depreciation in order to generate accurate financial statements.

2-Transform accounting fundamentals

The more your ability to handle payables and receivables, the more accurately and easily you can plan for development and respond to the unexpected. Financial management software enables real-time tracking of payables, receivables, assets, and liabilities, keeping the general ledger up-to-date and facilitating the preparation of the balance sheet, income statement, and cash flow statement.

Several of these systems automate activities associated with payables and receivables, eliminating human processes and allowing businesses to shorten transaction cycles and spot transactions that deviate from established standards, thereby protecting a company’s revenue stream and credit standing.

Your employees, like your business, are always evolving. Imagine a financial management system that facilitates mobile data access and analysis on many devices.

3-Predict change with astute perceptions

Using artificial intelligence and machine learning to provide insights into future cash flow; forecasting when invoices will be paid and transforming unanticipated deficits into predictable, plannable events.

Such systems help expedite the process of establishing and maintaining detailed short- and long-term budgets, allowing for more informed strategic planning and keeping the organisation on track.

4-Simplify and automate financial processes

The best financial management tools on the market provide advanced features for enhanced visibility and insight, as well as cloud connectivity for 24/7 access. These systems include advanced financial management capabilities and automated workflows that elevate management and reporting activities.

6-Simplify expenditure management

Manual expense management is time-consuming for employees, supervisors, and finance departments. A modern financial management system facilitates the completion and submission of expenditure reports by employees and minimises the time required for reconciliation and approval by the finance department.

6-Manage and monitor transactions

The cash and bank management capability of a financial management system simplifies the administration of a company’s bank accounts and the accompanying financial instruments, such as deposit slips, checks, bills of exchange, and promissory notes, and streamlines bank statement reconciliation.

7-Take charge of expenses

Advanced financial management software includes cost accounting capabilities that enable a company’s management team to capture and analyse all fixed and variable production costs. This offers a great deal of flexibility and simplicity to the cost accounting process, allowing the team to identify deviations from set criteria and make adjustments to aid in future cost control.

The most sophisticated systems enable users to import data from numerous financial data repositories—across entities and currencies—in order to provide a truly global perspective of a company’s financial condition.

8-Gain a better perspective on your position

Best-of-breed financial management systems include business intelligence tools that provide comprehensive, customizable dashboards for a comprehensive view of a company’s financial standing, as well as access to related financial reports and the capability to drill down to line-item details for a close examination of underlying transaction data. Financial and management professionals gain visibility into critical KPIs and highly accurate reports in real time, enabling them to make more informed business decisions.

Look for a financial management platform that is at least as global as your organisation when comparing options. Select a system that can support the regulatory needs of all the countries in which you conduct business.

9-Acquire a global viewpoint

A sophisticated financial management system enables finance professionals at multinational organisations to quickly adapt to changing local and global financial requirements, as well as to manage frequently changing national and regional tax, regulatory, and reporting requirements to ensure compliance and reduce risk.

Modern financial management systems utilise the cloud to enable authorised workers across the enterprise and the globe to see, analyse, and update essential data and KPIs in real-time, from any location and on any device.

10- Enhance company planning and projections

From budgeting to long-term planning to measuring the impact of mergers and acquisitions, a contemporary financial management system helps finance professionals to more properly assess and evaluate the future financial implications of planned or projected business choices.

11-Promote more prudent business decisions

A strong financial management system enables company and finance professionals to plan and govern operations using data-driven budgets. These solutions streamline the creation and maintenance of detailed personnel budgets, which simplifies position and compensation planning, and allow you to construct budgets for fixed assets that compute depreciation and record anticipated transactions associated with those assets.

You can also develop demand projections based on historical transaction data to estimate future inventory demand.

12- Build innovative financial models

Financial management software facilitates the creation of complex financial models that enable firms to evaluate their present valuation in comparison to that of their peers and competitors. Additionally, businesses can use models to predict sales growth, the viability of proposed projects, and the impact of potential mergers or projected economic conditions on the business.

Summary

Microsoft Dynamics Financial Management System is a powerful software solution that helps businesses manage their financial operations effectively. It provides real-time financial visibility, automates accounting processes, streamlines financial reporting, and enhances decision-making capabilities. The system also ensures compliance with financial regulations and helps businesses reduce the risk of financial errors and fraud. With its comprehensive financial management features, Microsoft Dynamics can help businesses improve their financial performance, increase profitability, and drive growth. Overall, Microsoft Dynamics Financial Management System is an essential tool for any business looking to manage its finances efficiently and effectively.