Introduction

In today’s fast-paced business world, organizations are embracing digital transformation, particularly in finance.

In today’s fast-paced business world, organizations are embracing digital transformation, particularly in finance.

Traditional paper-based processes can be time-consuming, error-prone, and hinder efficient decision-making.

Microsoft Dynamics 365 Finance and Operations offers advanced digital solutions that can revolutionize finance operations.

This comprehensive ERP solution offers features that streamline financial processes, enhance accuracy, and provide valuable insights into financial performance.

The process of upgrading finance from paper to digital involves assessing the need for digitalization, planning implementation, and leveraging the system’s capabilities to automate accounting processes, streamline budgeting and forecasting, enhance invoicing and payment processes, and improve financial reporting and analysis.

By following this guide, businesses can optimize their financial operations, drive efficiency, and empower finance teams to focus on strategic initiatives.

What is the history of financial management?

The foundational accounting practices that underpin financial management originated in ancient civilizations, where its illustrious history can be traced.

Financial management evolved over time, from the clay tablets utilized by the Sumerians in ancient Mesopotamia to the double-entry bookkeeping system implemented by the Romans.

Banking and limited liability were introduced during the Middle Ages and Renaissance, whereas the Industrial Revolution necessitated the development of more sophisticated financial systems.

Financial theories and models emerged during the 20th century, establishing the groundwork for contemporary financial management.

The digital era revolutionized financial management through the implementation of technological advances, including predictive modeling, real-time data analysis, and automation. ERP systems and sophisticated software solutions are currently utilized by organizations to streamline financial operations.

Financial management will persistently transform in tandem with technological progress, assimilating nascent patterns such as automation and blockchain in order to streamline the decision-making process and propel strategic financial administration.

Automated Accounting Processes

Automated accounting processes use technology and software to streamline and optimize accounting tasks and workflows.

They reduce manual effort, improve accuracy, enhance efficiency, and free up time for finance teams to focus on strategic initiatives.

Key aspects of automated accounting processes include data entry and recording, general ledger management, accounts payable and receivable, financial reporting, compliance, integration with other systems, and workflow automation.

Data entry and recording are eliminated by electronic capture and integration of financial data from various sources, reducing errors and ensuring data consistency.

General ledger management is facilitated by automatic recording and categorization of financial transactions, reducing human error and ensuring accurate records.

Automated accounting systems also streamline accounts payable and receivable processes, generating real-time financial reports and statements, and ensuring compliance with standards and regulations.

Integration with other systems like inventory management, sales, and procurement enhances operational efficiency. Workflow automation automates repetitive accounting tasks, streamlining processes and improving overall efficiency.

Advanced Budgeting and Forecasting: Microsoft Dynamics 365 Finance and Operations

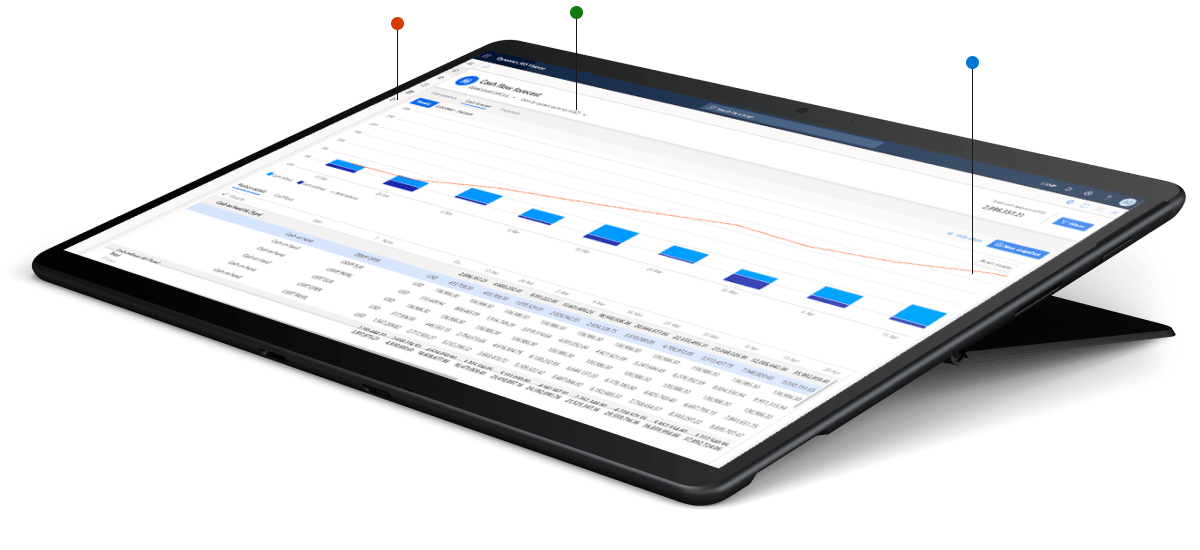

Microsoft Dynamics 365 Finance and Operations is a comprehensive financial management system designed to assist businesses in effectively planning and managing their finances.

It offers advanced budgeting and forecasting capabilities, allowing users to create and manage budgets for various organizational units, define budget lines, allocate amounts, and set targets.

The system also allows for the creation of multiple budget versions and scenarios, enabling businesses to plan and compare different financial scenarios.

It also provides robust budget control features, allowing users to monitor actual spending and take proactive measures to manage financial performance.

The system also supports forecasting and variance analysis, allowing businesses to compare actuals against forecasts to identify deviations and make necessary adjustments.

It also allows for what-if analysis, allowing businesses to assess the impact of changes in factors like sales volume, pricing, or cost structures on their financial performance.

The system also facilitates collaborative budgeting, allowing multiple users to contribute to the process and track changes.

Powerful Reporting and Analytics

Microsoft Dynamics 365 Finance and Operations is a comprehensive financial management system that offers a range of reporting and analytics capabilities.

It offers flexible reporting tools, real-time access to financial data, and a comprehensive set of standard financial reports, such as balance sheets, income statements, cash flow statements, and trial balances.

The system integrates with powerful analytics tools like Power BI, enabling advanced data analysis and deeper insights.

For organizations with multiple subsidiaries or international operations, the system supports consolidated financial reporting, ensuring accurate and comprehensive reporting at the group level.

Key Performance Indicators (KPIs) are defined and tracked to align with financial goals and objectives. By monitoring KPIs, businesses can assess their financial performance against targets, identify areas of improvement, and take proactive measures to drive financial success.

Ad Hoc query and analysis are also available, allowing users to explore financial data dynamically.

On-the-fly queries, filters, and drill-downs into transactional details allow users to answer specific financial questions and gain deeper insights.

By leveraging the powerful reporting and analytics capabilities of Microsoft Dynamics 365 Finance and Operations, businesses can access timely and accurate financial information, analyze performance, identify trends, and make data-driven decisions to drive financial growth and optimize overall business success.

Compliance and Security

Microsoft Dynamics 365 Finance and Operations is a platform that prioritizes data protection and regulatory compliance.

The platform employs robust security measures, including encryption at rest and in transit, to safeguard sensitive data.

It adheres to industry standards such as GDPR, HIPAA, and ISO 27001, ensuring the platform meets the necessary requirements for handling sensitive data across different sectors.

The platform also offers role-based security, allowing users to define user roles and assign specific access rights based on job responsibilities, minimizing the risk of unauthorized access.

The platform maintains a comprehensive audit trail, recording user activities and system changes, ensuring accountability and transparency.

Regular data backups and disaster recovery options are provided to protect critical business data. Microsoft regularly releases security updates and patches to address vulnerabilities and protect against emerging threats.

Compliance reporting is also available, allowing users to generate reports on data access, user activities, and system changes, demonstrating compliance with regulations and internal policies.

Despite Microsoft’s commitment to security and compliance, it is crucial to consider other factors such as user experience, data privacy, and the need for robust security measures.

Scalability and Cloud-Based Deployment

Microsoft Dynamics 365 Finance and Operations is a flexible and adaptable platform designed to accommodate business needs, allowing for increased transaction volumes, user numbers, and data storage.

Its scalability allows for rapid deployment, reducing implementation time compared to traditional on-premises solutions.

The cloud-based deployment allows for easy elasticity, allowing for cost-effective resource allocation.

Accessibility is also a key advantage, allowing users to work remotely and securely access the platform.

Cloud deployment eliminates the need for on-premises infrastructure management, reducing the burden of hardware maintenance, software updates, and security patching.

It also provides built-in disaster recovery capabilities, replicating data across multiple data centers for data redundancy and minimizing data loss risks.

The platform integrates seamlessly with other Microsoft products and services, allowing for the creation of custom applications, workflows, and reports, creating a comprehensive solution tailored to specific business requirements.

Overall, Microsoft Dynamics 365 Finance and Operations offers a flexible and adaptable solution for businesses.

Conclusion

In summary, Microsoft Dynamics 365 Finance and Operations provides comprehensive security and compliance functionalities, guaranteeing data protection and adherence to industry standards.

Your sensitive information is safeguarded with the assistance of role-based security, audit trails, and data backup functionalities.

Moreover, the scalability and cloud-based deployment of the platform affords enterprises the necessary adaptability and flexibility to expand and develop.

The capability to rapidly deploy the solution, scale resources with ease, and access it from any location facilitates remote work and collaboration.

Through the utilization of cloud technology and seamless integration with additional Microsoft services, Dynamics 365 Finance and Operations facilitates extensibility and integration, thereby granting users the ability to customize the platform according to their particular business needs.

In its entirety, Microsoft Dynamics 365 Finance and Operations constitute an all-encompassing solution that amalgamates scalability, compliance, security, and cloud-based deployment.

Its primary objectives are to facilitate the expansion of your organization, augment operational efficacy, and propel digital transformation.